Vasant Kunj during its starting days was a good destination for central govt Babus. Mostly one could find Honest Govt./ PSU’s employees in every other household of VK in late 90s. Gradually children grew up and moved out of India and out of Delhi for Jobs forcing many to sell their dream homes to accompany their children. Now younger/ middle aged professionals are moving in.

In early 2000 there used to be huge demand of CGHS dispensary in VK to serve our Babus and many RWAs and federation made great efforts not realising what would be the actual requirement of the future population. The new generation did not demand even a single Govt run Hospital with the result most land earmarked for govt hospitals were allotted to private entities, resulting in expensive healthcare for private non-Babus. Most of our middle class is left with no option but opt for expensive health insurance that too available only in case one gets hospitalized. The premiums of health insurance are being paid by income tax payees with no benefit in tax exemptions.

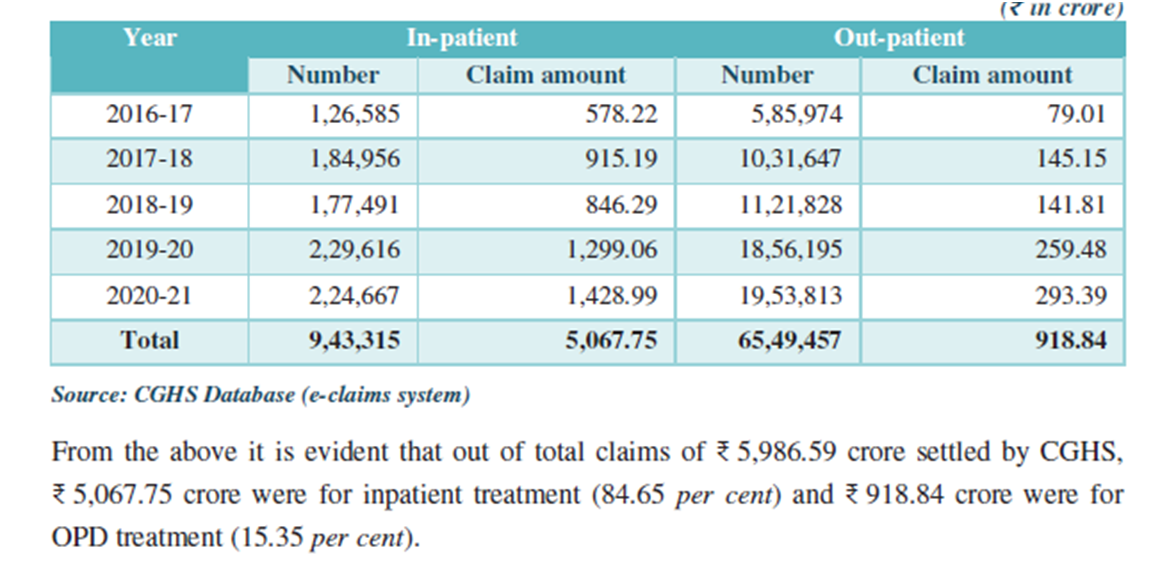

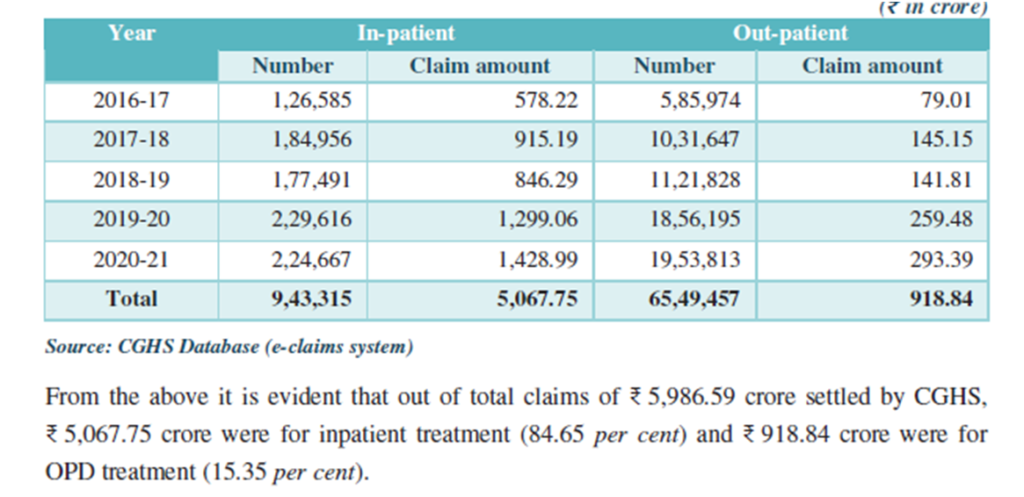

The table above is an eye opener for general public. As it’s only the central govt employees’ expenses. As per current data there are about 7 lakhs serving employees with 26.50 lakh dependents and about 8.96 lakh pensioners with 18.28 lakh dependents totalling about 44.77 lakh beneficiaries that incurred about Rs. 1722 crores in the year 2020-21. Average per employee cost works out Rs.10,800 to govt.

While most of us are paying many times higher premiums like Rs. 33, 075 plus Rs.5954 GST for health insurance on only 4 lakh coverage. While about 12 crores families (55 crores people) are given 5 lakhs health insurance premium paid by government under PM-JAY scheme (7500 crores budget) while Tax paying community is exploited with premium plus GST for even one lakh coverage, which is unconstitutional and indefensible.

We are being charged @18% GST (highest luxury slab) for the coverage which is the fundamental duty of government towards its taxpaying community. When Governments including state govts. are in business mode, how can they work for welfare of general public.

We recommend the following for the People’s Manifesto: Health: 1. All income tax payers should be treated at par with Govt employees based on their income brackets w.r.t. their health/hospitalization needs. 2. Full incomeexemption on premium paid for family health coverage upto 5 lakhsin new tax regime. 3. No GST or other taxes on premiums paid in category up to 5 lakhs or at par with PM-JAY. 4. Expenses of EWS services rendered by private hospitals should be state’s responsibility instead on general patient already in distress.

Popular Stories

Football Tournament @Princeton

More Than a Festival: The Art and Power of Durga Puja

Personality of the Month- ‘Dr Usha Mediratta’

Stray Cattle Menace In Front of Galleria

The Chronicles of Malibu Towne: A Mosquito’s Tale

“Senior Living Is Not An Old Age Home” say Mr & Mrs Bose

Recent Stories from Nearby

- Promises Repair of Broken Park Walls, Installation of Boom Barriers, Deep Cleaning of Drains… Among Other Things January 30, 2025

- Anand Niketan Club’s Grand New Year’s Eve Bash January 30, 2025

- Residents Come Together for a Night of Fun and Festivity January 30, 2025

- Rising Incidents of Harassment by Transgender Groups Raise Concerns in Delhi NCR January 30, 2025

- From Banana Races to Hurdles: ANRWA Sports Meet Had It All January 30, 2025