That Covid took away several lives is something we may want to forget but we can’t! The magnitude of the tragedy was not only unpredictable but also unprecedented! Most people experienced it in one way or the other. A precious life was lost of either a member of the family or extended family, or a friend or an acquaintance, young or old!

But the consequences of the loss of a husband affected wives the most! The suddenness overwhelmed them. They had to run the household, bring up the children, and manage the finances.

Bank accounts were there but with husband as the sole a/c holder and no nominee. Investments in property and the stock market were there but again in the husband’s name. There was no written & registered will! No easy access to information on insurance policies, loans taken, unpaid income tax, property tax, and other liabilities if any.

Wives regretted that they showed no interest when husbands shared financial details with them.

The macro picture in India reveals some disturbing facts –

a. Over Rs18830 crore worth of assets lying unclaimed in banks (as of 2019).

b. Against 75 % literacy, only 24 % are financially literate.

c.72 % of people doesn’t seem to know where to invest their savings. Even 51 % millennials don’t know enough.

d. Most people save only what is left after spending! Wiser to spend what is left after you save (at least 20%).

Let us now try and understand what financial literacy is and what specifically is required to be done in the Indian context.

1. Include Financial Literacy as an important subject in school curriculum. Australia, the U.S., and Russia have already made a beginning.

2. All personal bank accounts should be joint if possible but always with a nominee. The nominee is only a manager of accounts but the money would be distributed only amongst the legal heirs. For banks, it is easy to transfer money to the nominee after a/c holder’s death.

3. Investments in property and the stock market must be in joint names (e.g. husband and wife). In case of death of one of them, only a death certificate needs to be submitted, for the survivor to become the sole owner. Many husbands buy property in their wives’ name to avail of lower rates of stamp duty and save on costs.

4. Death certificates can be obtained online from the MCD. It is advisable to collect multiple originals (say 25) on payment as photocopies are generally not accepted.

5. It is a good idea to make a will specifying how movable and immovable assets are to be distributed after your death. Try and use a doctor and a lawyer along with the beneficiaries as witnesses. Get the will registered and give a copy to each beneficiary.

In the absence of a will, the assets would be distributed equally amon-gst the wife and each one of the children as per Indian laws.

6. Husband and wife must make a list of all assets and liabilities and update it every month.

Popular Stories

Football Tournament @Princeton

More Than a Festival: The Art and Power of Durga Puja

Personality of the Month- ‘Dr Usha Mediratta’

Stray Cattle Menace In Front of Galleria

The Chronicles of Malibu Towne: A Mosquito’s Tale

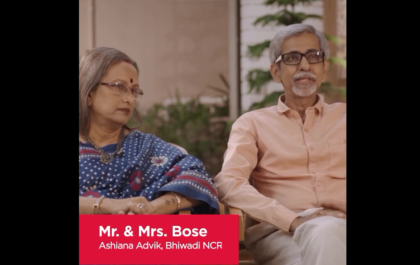

“Senior Living Is Not An Old Age Home” say Mr & Mrs Bose

Recent Stories from Nearby

- MLA Parmila Tokas Meets Members of the Anand Niketan Residents’ Welfare Association December 26, 2024

- From Public Park to Private Garden: The Story of Compost in Shanti Niketan December 26, 2024

- Maha Tambola Afternoon At Anand Niketan Club December 26, 2024

- Anand Niketan Residents Rally for Stray Dog Solutions December 26, 2024

- An Activist Tells Her Story December 26, 2024