My neighbour and good friend, a retired army officer was a victim of a Cyber Digital Fraud very recently. He received text a message on his phone that his request of E-Sim has been accepted. My friend had not put in a request for the E- Sim or neither answered any phone calls nor did he share any personal details or OTP. Later, messages from his three banks about withdrawals, without his knowledge, alarmed him. He later found out that he had been scammed of a total of over Rs. 6 lacs by the digital fraudsters through ‘SIM Swap fraud’. In today’s digital age, the threat of fraud is ever-present. One type of fraud that has gained significant attention in recent years is Sim Swap Fraud. This form of fraud targets individuals’ mobile phones, allowing scammers to gain unauthorized access to personal information and potentially wreak havoc on victims’ lives.

What is Sim Swap Fraud?

Sim Swap Fraud, also known as Simjacking, is a sophisticated scam in which fraudsters steal your mobile phone number by transferring it onto a new Sim card. By doing so, they gain control over your phone, receiving all calls and messages meant for you. This allows them to intercept sensitive information, such as passwords, banking details, and personal data, potentially leading to identity theft and financial loss.

Once fraudsters have successfully executed a Sim Swap, they can gain access to your personal accounts and wreak havoc on your finances. They may attempt to transfer funds out of your bank account, make unauthorized purchases using your credit cards, or even take over your social media accounts to spread malicious content. One of the most alarming aspects of Sim Swap Fraud is how easily it can be carried out. Fraudsters often gather personal information about their victims through various means, such as phishing emails or social engineering techniques. Armed with this information, they contact the victim’s mobile service provider, pretending to be the account holder, and request a Sim card replacement. Mobile service providers are often unaware of the fraudulent nature of these requests and proceed with the Sim card transfer, believing they are assisting a legitimate customer. Once the Sim card is activated on the fraudster’s device, the victim’s phone becomes completely useless, while the fraudster gains full control over their phone number.

To protect yourself from Sim Swap Fraud, it is crucial to be vigilant and take necessary precautions. Avoid sharing personal information online or responding to suspicious emails and messages. Regularly monitor your bank accounts and mobile phone activity for any unauthorized transactions or unusual behaviour. Additionally, consider adding extra layers of security to your accounts, such as enabling two-factor authentication and using strong, unique passwords.

Steps to Prevent Sim Swap Fraud

Protecting yourself from Sim Swap Fraud requires a combination of proactive measures and increased awareness. Here are some steps you can take to minimize the risk: 1. Secure Your Personal Information: Be cautious about sharing personal details online and regularly update your privacy settings on social media platforms. Limit the amount of personal information that is publicly available.

2. Use Strong and Unique Passwords: Create complex passwords for all your online accounts and avoid reusing them across different platforms. Consider using a password manager to securely store your passwords.

3. Enable Two-Factor Authentication: Implement two-factor authentication on your accounts whenever possible. This adds an extra layer of security by requiring a second verification step, such as a code sent to your mobile phone.

4. Monitor Your Accounts: Regularly review your bank statements, phone bills, and other financial records to detect any suspicious activity. If you notice any unauthorized transactions or discrepancies, contact your provider immediately.

5. Use Additional Security Measures: Explore the use of security features such as biometric authentication (fingerprint or face recognition) or physical security keys to provide an extra level of protection.

Reporting Sim Swap Fraud: What to do if you’re a victim If you believe you have fallen victim to Sim Swap Fraud, swift action is essential. Contact your mobile network provider immediately to report the incident and request that they disable your Sim card. Additionally, notify your bank and other financial institutions to alert them of the potential risk of fraud. Keep records of all communication and evidence related to the incident, as this will aid in any subsequent investigations. You should also report the fraud to your local law enforcement agency ie the Cyber Security Cell of the Police, providing them with all the necessary details to help with their investigations. Remember, the sooner you report the fraud, the greater the chance of recovering any losses and apprehending the individuals behind it.

Popular Stories

Football Tournament @Princeton

More Than a Festival: The Art and Power of Durga Puja

Personality of the Month- ‘Dr Usha Mediratta’

Stray Cattle Menace In Front of Galleria

The Chronicles of Malibu Towne: A Mosquito’s Tale

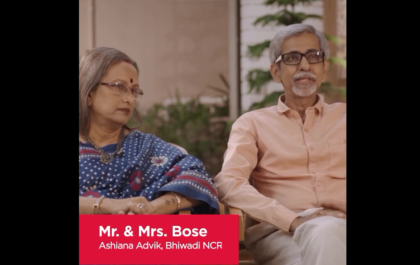

“Senior Living Is Not An Old Age Home” say Mr & Mrs Bose

Recent Stories from Nearby

- Araya Samaj Hauz Khas New Delhi December 27, 2024

- AGM At Adhya Jha December 27, 2024

- Petty Thefts on the Rise December 27, 2024

- Water Sprinklers in SDA December 27, 2024

- Town Hall Meeting With Parmila Tokas December 27, 2024